6.6 The Rise of Industrial Capitalism

7 min read•january 26, 2023

Robby May

Ashley Rossi

Riya Patel

Robby May

Ashley Rossi

Riya Patel

Railroads and Cornelius Vanderbilt

The expansion of the railroad system in the United States after the Civil War had a significant impact on the country's economic and social development. The increase in railroad mileage made it possible to transport goods and people over long distances quickly and efficiently. This led to the creation of a national market for goods, which in turn encouraged mass production and mass consumption.

The introduction of new technologies such as air brakes, refrigerator cars, dining cars, heated cars, and electric switches transformed the railroad industry, making it safer and more comfortable for passengers and more efficient for shipping goods. The popularity of 's lavish sleeping cars also contributed to the transformation of the railroad industry, making long-distance travel more comfortable and accessible for people.

Furthermore, the expansion of the railroad system also facilitated economic specialization as it allowed for the movement of goods and people between different regions, thereby encouraging the growth of industries in areas that had access to natural resources and other advantages.

Overall, the expansion of the railroad system in the United States after the Civil War had a significant impact on the country's economic and social development, making it possible to transport goods and people over long distances quickly and efficiently, creating a national market for goods, facilitating economic specialization and making long distance travel more comfortable and accessible.

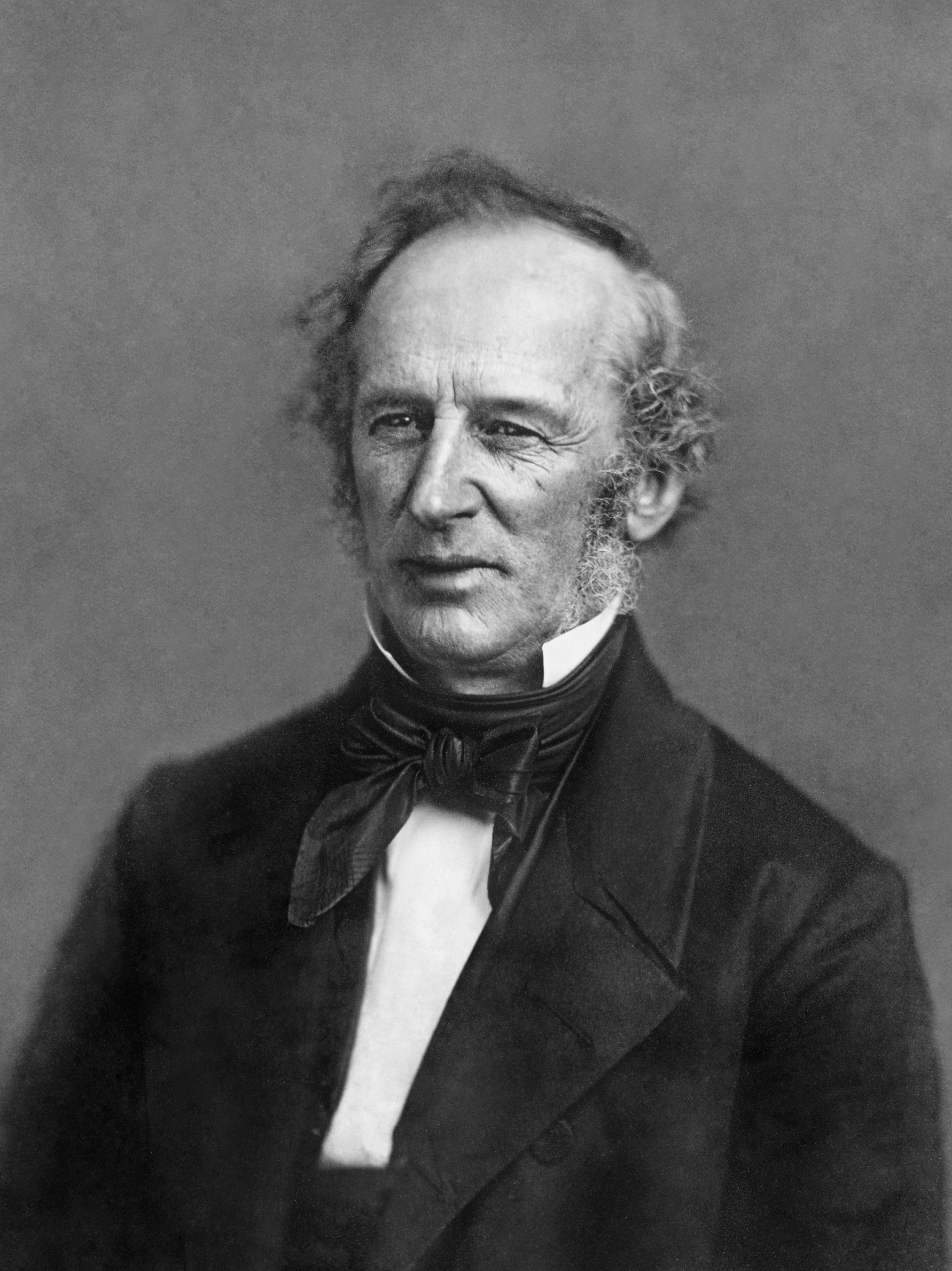

Image Courtesy of Wikimedia

, also known as "Commodore" Vanderbilt, was a successful businessman who used his fortune from the steamboat industry to merge local into the , which ran from New York City to Chicago and operated more than 4,500 miles of track.

The federal government also played a role in the expansion of the railroad system by providing subsidies in the form of loans and land grants to railroad companies. This led to the construction of many new , particularly in the western United States, which facilitated the settlement of these regions.

However, the rapid expansion of the railroad industry also led to some negative consequences. During speculative bubbles, investors often overbuilt new technologies, leading to overcapacity in the industry. also suffered from mismanagement and outright fraud, with some speculators entering the industry for quick profits and engaging in practices such as selling off assets and watering stock.

To survive, competed by offering rebates and kickbacks to favored shippers while charging exorbitant freight rates to smaller customers such as farmers. This led to a financial panic in 1893, which forced a quarter of all into bankruptcy. J. Pierpont Morgan and other bankers quickly moved in to take control of the bankrupt and consolidate them, leading to the creation of large railroad monopolies.

Steel and Carnegie

In the 1850s, both in England and in the US discovered that blasting air through molten iron produced high-quality steel (a more durable metal than iron).

was the undisputed master of the industry. South of Pittsburgh, he built the , named after the president of the Pennsylvania Railroad, who was his biggest customer. In 1878 he won the steel contract for the . He also would provide the steel for NYC’s elevated railways and skyscrapers and the .

In 1901 he sold the company believing that wealth brought social obligations and he wanted to devote his life to philanthropy. JP Morgan bought it as he was Carnegie's chief competition in the . Carnegie sold it for a half billion dollars. Drawing other companies into the combination in 1901, Morgan announced the creation of the .

Rockefeller and the Oil

In the 1850s, petroleum was a bothersome, smelly fluid that occasionally rose to the surface of springs and streams. Some entrepreneurs bottled it in patent medications and others burned it. Soon it was discovered that by drilling, you could reach pockets of it under the earth. imposed order on the industry.

Rockefeller absorbed or destroyed competitors in Cleveland and elsewhere. Unlike Carnegie, he was distant. He had deep religious beliefs and taught Bible classes.

He demanded efficiency and relentless cost cutting. He counted the stoppers in barrels, shortened barrel hoops to save metal, and reduced the number of drops of solder on kerosene cans from 40 to 39. He realized that even small reductions meant huge savings. By 1879, through his company, , he controlled 90% of the country’s entire oil-refining capacity.

Some people at the time viewed these men as corrupt and harmful while others saw them as brilliant and innovative captains of industry. Which is closer to the truth? Well, that’s for you to argue.

🎥 Watch: AP US History - Period 6 Review

New Business Organization

Business leaders used new tactics to consolidate wealth and drive out competition.

Explanation | |

The control of multiple stages of production and distribution within a single company. This can include control over raw materials, manufacturing, and distribution of a product. Examples of include:

| |

The integration of an industry, in which former competitors were brought under a single corporate umbrella. This can include the control of multiple factories or retail outlets within a specific region or industry. Examples of include:

| |

A legal entity in which a group of companies or assets are placed under the control of a small group of individuals or a holding company. The purpose of a trust is to reduce competition and increase market control within an industry. Examples of include:

| |

A company that owns the stock of other companies, giving it control over the operations of those companies. can be used for a variety of purposes, including the consolidation of multiple companies within an industry, the management of multiple business operations, and the acquisition of new companies or assets. Examples of include:

|

Capitalism

As early as 1776, economist had argued in that business should be regulated, not by government, but by the “invisible hand” of the law of supply and demand. If the government kept its hands off (), so the theory went, businesses would be motivated by their own self-interest to offer improved goods and services at low prices.

’s theory of natural selection in biology presented new views of economics for some. Some people argued that , the belief that Darwin’s ideas of natural selection and survival of the fittest, should be applied to the marketplace. They believed that concentrating wealth in the hands of the “fit” benefited everyone.

Gospel of Wealth

, one of the most successful industrialists and philanthropists of the 19th century, was a devout Baptist who believed that his wealth was a blessing from God. He often cited the Bible verse Proverbs 13:22, which states "A good man leaveth an inheritance to his children's children: and the wealth of the sinner is laid up for the just" as evidence that God had given him his riches as a reward for his hard work and good deeds.

Rockefeller's religious beliefs played a significant role in his business practices and philanthropy. He believed that his wealth was a responsibility and that he had a moral obligation to use it for the betterment of society. He donated millions of dollars to various charitable causes and organizations, including education, health care, and the arts. He also believed that his business practices should be guided by Christian principles such as honesty, integrity, and fairness.

Rockefeller's religious beliefs and philanthropy helped to soften the negative public perception of him and other wealthy industrialists. Many Americans viewed the wealth of the "" as a sign of divine favor and justification of the capitalist system. This perspective helped to legitimize the growing wealth gap in the United States and the concentration of wealth and power in the hands of a few individuals and corporations.

's article “Wealth” argued that the wealthy had a God-given responsibility to carry out projects of civic philanthropy for the benefit of society, the idea of the . He himself distributed more than $350 million of his fortune to support the building of libraries, universities and various public institutions.

Key Terms to Review (27)

Adam Smith

: Adam Smith was an economist and philosopher who wrote what is considered the "bible" of capitalism, "The Wealth Of Nations," where he details the first system of political economy.Andrew Carnegie

: Andrew Carnegie was a Scottish-American industrialist and philanthropist who led the expansion of the American steel industry in the late 19th century. He is also known for his article "The Gospel of Wealth."Berkshire Hathaway

: Berkshire Hathaway is an American multinational conglomerate holding company headed by Warren Buffett that oversees and manages various subsidiary companies.Brooklyn Bridge

: Completed in 1883, the Brooklyn Bridge connects Manhattan and Brooklyn by spanning the East River. It was the longest suspension bridge at its time of completion.Charles Darwin

: Charles Darwin was an English naturalist who developed the theory of evolution through natural selection. His work fundamentally changed our understanding about life on Earth.Cornelius Vanderbilt

: Cornelius Vanderbilt (1794-1877) was an American business magnate who built his wealth in shipping and railroads during the 19th century. He is known as one of America's leading industrialists at that time.Federal Steel Company

: The Federal Steel Company was an American steel conglomerate founded in 1898 by some prominent industrialists including J.P. Morgan.George Pullman

: George Pullman (1831-1897) was an American industrialist and inventor best known for developing the Pullman sleeping car, a luxury railway car with seats that converted into beds for overnight journeys.Gospel of Wealth

: The Gospel of Wealth is an article written by Andrew Carnegie in 1889 where he argued that wealthy individuals have a moral obligation to distribute their wealth in ways that promote the welfare and happiness of others.Henry Bessemer

: Henry Bessemer was an English inventor who created a new process for making steel from iron in 1856 known as the Bessemer Process.Holding Companies

: A holding company is a type of firm that owns other investments, including whole companies, instead of engaging in its own operations.Horizontal Integration

: Horizontal integration is a business strategy where a company acquires, merges with or takes over another company in the same industry value chain.J. Edgar Thomson Steel Works

: Named after Pennsylvania Railroad president J. Edgar Thomson, this steel mill located near Pittsburgh was one of America's largest producers of steel during the late 19th century.John D. Rockefeller

: John D. Rockefeller was an American business magnate and philanthropist who is considered as one of the richest individuals in modern history due to his founding role in Standard Oil Company.Laissez-faire

: Laissez-faire is an economic theory that advocates for minimal government intervention in business affairs beyond what's necessary to maintain peace and property rights.New York Central Railroad

: The New York Central Railroad was a major railroad operating in the Northeastern United States during the 19th and early 20th centuries. It was known for its Water Level Route, which avoided the steep grades of other railroads through much of upstate New York.Railroads

: A railroad is a track or set of tracks made of steel rails along which passenger and freight trains run. Railroads were instrumental in the industrial development and westward expansion of the United States during the 19th century.Robber Barons

: Robber barons is a derogatory term used during America's Gilded Age (late 19th century) for wealthy industrialists who amassed their fortunes through ruthless business practices such as exploiting workers or manipulating markets.Social Darwinism

: Social Darwinism is a theory that applies the concept of "survival of the fittest" from biological evolution to human societies. It suggests that societal progress comes from competition and natural selection among individuals, races, or nations.Standard Oil

: Standard Oil was an American oil producing, transporting, refining, and marketing company established in 1870 by John D. Rockefeller and his associates. It became one of the world's first and largest multinational corporations until it was broken up by the U.S government in 1911 due to antitrust laws.The Wealth of Nations

: "The Wealth of Nations" is a book written by Adam Smith in 1776, which outlines the principles of free market economics and capitalism. It argues that self-interest and competition are driving forces behind economic prosperity.Trusts

: In terms of U.S history, trusts refer to large business entities that are formed with intent to monopolize and control market share by eliminating competition through consolidation of companies.United States Steel Corporation

: The United States Steel Corporation, often referred to as U.S. Steel, is a major steel producing company established in 1901 by J.P. Morgan and Elbert H. Gary. It was the world's first billion-dollar corporation and was once the largest steel producer and largest corporation in the world.US Steel Corporation

: The U.S. Steel Corporation is an integrated steel producer with major production operations in the United States, Canada, and Central Europe, founded by J.P. Morgan and Elbert H. Gary in 1901.Vertical Integration

: Vertical integration is when a company controls more than one stage of the supply chain for a product, from the raw materials to manufacturing and distribution.Washington Monument

: The Washington Monument is an obelisk on the National Mall in Washington, D.C., built to commemorate George Washington, the first President of the United States.William Kelly

: William Kelly was an American inventor and businessman who played a significant role in the development of the Bessemer process for steel production.6.6 The Rise of Industrial Capitalism

7 min read•january 26, 2023

Robby May

Ashley Rossi

Riya Patel

Robby May

Ashley Rossi

Riya Patel

Railroads and Cornelius Vanderbilt

The expansion of the railroad system in the United States after the Civil War had a significant impact on the country's economic and social development. The increase in railroad mileage made it possible to transport goods and people over long distances quickly and efficiently. This led to the creation of a national market for goods, which in turn encouraged mass production and mass consumption.

The introduction of new technologies such as air brakes, refrigerator cars, dining cars, heated cars, and electric switches transformed the railroad industry, making it safer and more comfortable for passengers and more efficient for shipping goods. The popularity of 's lavish sleeping cars also contributed to the transformation of the railroad industry, making long-distance travel more comfortable and accessible for people.

Furthermore, the expansion of the railroad system also facilitated economic specialization as it allowed for the movement of goods and people between different regions, thereby encouraging the growth of industries in areas that had access to natural resources and other advantages.

Overall, the expansion of the railroad system in the United States after the Civil War had a significant impact on the country's economic and social development, making it possible to transport goods and people over long distances quickly and efficiently, creating a national market for goods, facilitating economic specialization and making long distance travel more comfortable and accessible.

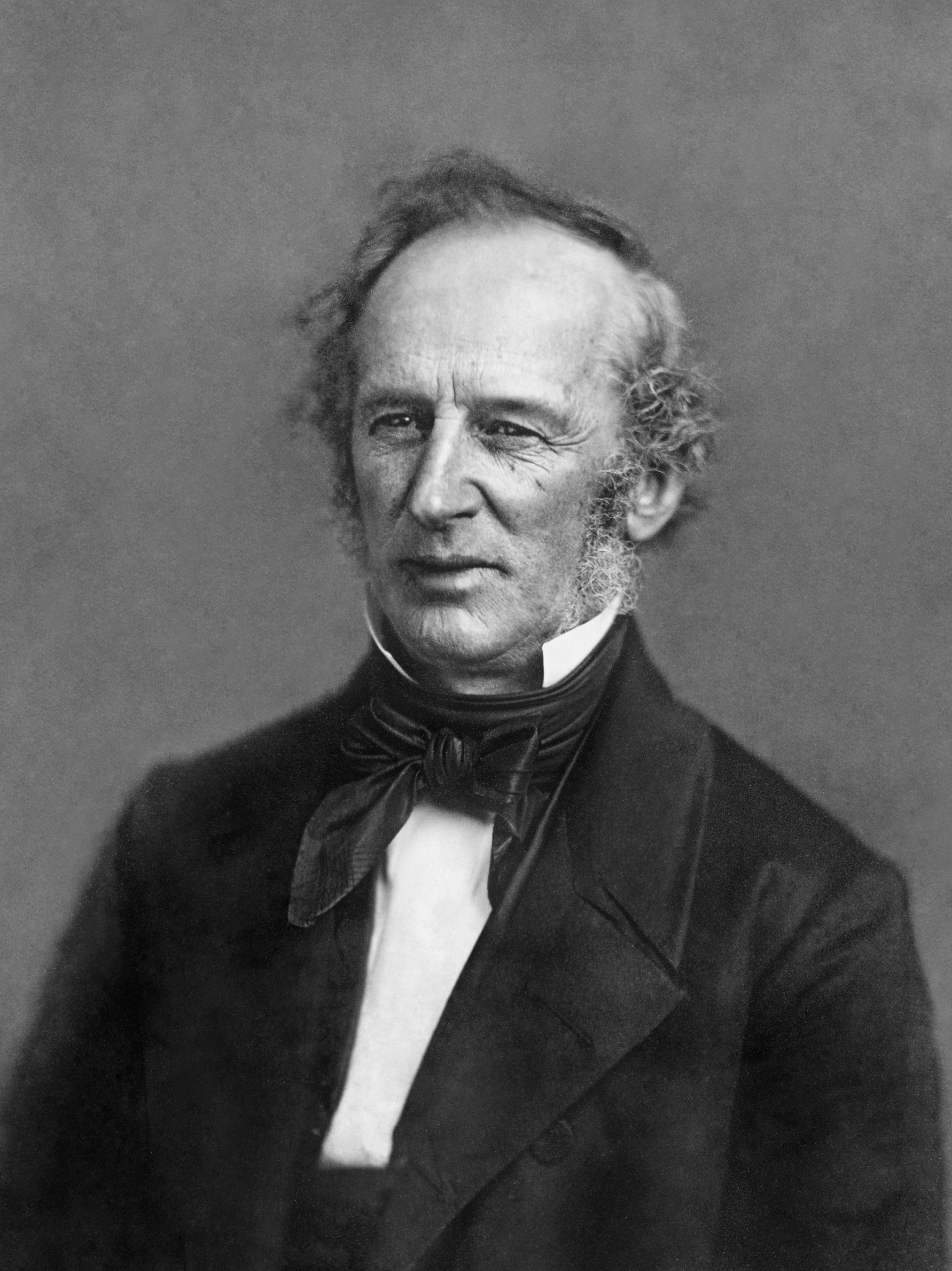

Image Courtesy of Wikimedia

, also known as "Commodore" Vanderbilt, was a successful businessman who used his fortune from the steamboat industry to merge local into the , which ran from New York City to Chicago and operated more than 4,500 miles of track.

The federal government also played a role in the expansion of the railroad system by providing subsidies in the form of loans and land grants to railroad companies. This led to the construction of many new , particularly in the western United States, which facilitated the settlement of these regions.

However, the rapid expansion of the railroad industry also led to some negative consequences. During speculative bubbles, investors often overbuilt new technologies, leading to overcapacity in the industry. also suffered from mismanagement and outright fraud, with some speculators entering the industry for quick profits and engaging in practices such as selling off assets and watering stock.

To survive, competed by offering rebates and kickbacks to favored shippers while charging exorbitant freight rates to smaller customers such as farmers. This led to a financial panic in 1893, which forced a quarter of all into bankruptcy. J. Pierpont Morgan and other bankers quickly moved in to take control of the bankrupt and consolidate them, leading to the creation of large railroad monopolies.

Steel and Carnegie

In the 1850s, both in England and in the US discovered that blasting air through molten iron produced high-quality steel (a more durable metal than iron).

was the undisputed master of the industry. South of Pittsburgh, he built the , named after the president of the Pennsylvania Railroad, who was his biggest customer. In 1878 he won the steel contract for the . He also would provide the steel for NYC’s elevated railways and skyscrapers and the .

In 1901 he sold the company believing that wealth brought social obligations and he wanted to devote his life to philanthropy. JP Morgan bought it as he was Carnegie's chief competition in the . Carnegie sold it for a half billion dollars. Drawing other companies into the combination in 1901, Morgan announced the creation of the .

Rockefeller and the Oil

In the 1850s, petroleum was a bothersome, smelly fluid that occasionally rose to the surface of springs and streams. Some entrepreneurs bottled it in patent medications and others burned it. Soon it was discovered that by drilling, you could reach pockets of it under the earth. imposed order on the industry.

Rockefeller absorbed or destroyed competitors in Cleveland and elsewhere. Unlike Carnegie, he was distant. He had deep religious beliefs and taught Bible classes.

He demanded efficiency and relentless cost cutting. He counted the stoppers in barrels, shortened barrel hoops to save metal, and reduced the number of drops of solder on kerosene cans from 40 to 39. He realized that even small reductions meant huge savings. By 1879, through his company, , he controlled 90% of the country’s entire oil-refining capacity.

Some people at the time viewed these men as corrupt and harmful while others saw them as brilliant and innovative captains of industry. Which is closer to the truth? Well, that’s for you to argue.

🎥 Watch: AP US History - Period 6 Review

New Business Organization

Business leaders used new tactics to consolidate wealth and drive out competition.

Explanation | |

The control of multiple stages of production and distribution within a single company. This can include control over raw materials, manufacturing, and distribution of a product. Examples of include:

| |

The integration of an industry, in which former competitors were brought under a single corporate umbrella. This can include the control of multiple factories or retail outlets within a specific region or industry. Examples of include:

| |

A legal entity in which a group of companies or assets are placed under the control of a small group of individuals or a holding company. The purpose of a trust is to reduce competition and increase market control within an industry. Examples of include:

| |

A company that owns the stock of other companies, giving it control over the operations of those companies. can be used for a variety of purposes, including the consolidation of multiple companies within an industry, the management of multiple business operations, and the acquisition of new companies or assets. Examples of include:

|

Capitalism

As early as 1776, economist had argued in that business should be regulated, not by government, but by the “invisible hand” of the law of supply and demand. If the government kept its hands off (), so the theory went, businesses would be motivated by their own self-interest to offer improved goods and services at low prices.

’s theory of natural selection in biology presented new views of economics for some. Some people argued that , the belief that Darwin’s ideas of natural selection and survival of the fittest, should be applied to the marketplace. They believed that concentrating wealth in the hands of the “fit” benefited everyone.

Gospel of Wealth

, one of the most successful industrialists and philanthropists of the 19th century, was a devout Baptist who believed that his wealth was a blessing from God. He often cited the Bible verse Proverbs 13:22, which states "A good man leaveth an inheritance to his children's children: and the wealth of the sinner is laid up for the just" as evidence that God had given him his riches as a reward for his hard work and good deeds.

Rockefeller's religious beliefs played a significant role in his business practices and philanthropy. He believed that his wealth was a responsibility and that he had a moral obligation to use it for the betterment of society. He donated millions of dollars to various charitable causes and organizations, including education, health care, and the arts. He also believed that his business practices should be guided by Christian principles such as honesty, integrity, and fairness.

Rockefeller's religious beliefs and philanthropy helped to soften the negative public perception of him and other wealthy industrialists. Many Americans viewed the wealth of the "" as a sign of divine favor and justification of the capitalist system. This perspective helped to legitimize the growing wealth gap in the United States and the concentration of wealth and power in the hands of a few individuals and corporations.

's article “Wealth” argued that the wealthy had a God-given responsibility to carry out projects of civic philanthropy for the benefit of society, the idea of the . He himself distributed more than $350 million of his fortune to support the building of libraries, universities and various public institutions.

Key Terms to Review (27)

Adam Smith

: Adam Smith was an economist and philosopher who wrote what is considered the "bible" of capitalism, "The Wealth Of Nations," where he details the first system of political economy.Andrew Carnegie

: Andrew Carnegie was a Scottish-American industrialist and philanthropist who led the expansion of the American steel industry in the late 19th century. He is also known for his article "The Gospel of Wealth."Berkshire Hathaway

: Berkshire Hathaway is an American multinational conglomerate holding company headed by Warren Buffett that oversees and manages various subsidiary companies.Brooklyn Bridge

: Completed in 1883, the Brooklyn Bridge connects Manhattan and Brooklyn by spanning the East River. It was the longest suspension bridge at its time of completion.Charles Darwin

: Charles Darwin was an English naturalist who developed the theory of evolution through natural selection. His work fundamentally changed our understanding about life on Earth.Cornelius Vanderbilt

: Cornelius Vanderbilt (1794-1877) was an American business magnate who built his wealth in shipping and railroads during the 19th century. He is known as one of America's leading industrialists at that time.Federal Steel Company

: The Federal Steel Company was an American steel conglomerate founded in 1898 by some prominent industrialists including J.P. Morgan.George Pullman

: George Pullman (1831-1897) was an American industrialist and inventor best known for developing the Pullman sleeping car, a luxury railway car with seats that converted into beds for overnight journeys.Gospel of Wealth

: The Gospel of Wealth is an article written by Andrew Carnegie in 1889 where he argued that wealthy individuals have a moral obligation to distribute their wealth in ways that promote the welfare and happiness of others.Henry Bessemer

: Henry Bessemer was an English inventor who created a new process for making steel from iron in 1856 known as the Bessemer Process.Holding Companies

: A holding company is a type of firm that owns other investments, including whole companies, instead of engaging in its own operations.Horizontal Integration

: Horizontal integration is a business strategy where a company acquires, merges with or takes over another company in the same industry value chain.J. Edgar Thomson Steel Works

: Named after Pennsylvania Railroad president J. Edgar Thomson, this steel mill located near Pittsburgh was one of America's largest producers of steel during the late 19th century.John D. Rockefeller

: John D. Rockefeller was an American business magnate and philanthropist who is considered as one of the richest individuals in modern history due to his founding role in Standard Oil Company.Laissez-faire

: Laissez-faire is an economic theory that advocates for minimal government intervention in business affairs beyond what's necessary to maintain peace and property rights.New York Central Railroad

: The New York Central Railroad was a major railroad operating in the Northeastern United States during the 19th and early 20th centuries. It was known for its Water Level Route, which avoided the steep grades of other railroads through much of upstate New York.Railroads

: A railroad is a track or set of tracks made of steel rails along which passenger and freight trains run. Railroads were instrumental in the industrial development and westward expansion of the United States during the 19th century.Robber Barons

: Robber barons is a derogatory term used during America's Gilded Age (late 19th century) for wealthy industrialists who amassed their fortunes through ruthless business practices such as exploiting workers or manipulating markets.Social Darwinism

: Social Darwinism is a theory that applies the concept of "survival of the fittest" from biological evolution to human societies. It suggests that societal progress comes from competition and natural selection among individuals, races, or nations.Standard Oil

: Standard Oil was an American oil producing, transporting, refining, and marketing company established in 1870 by John D. Rockefeller and his associates. It became one of the world's first and largest multinational corporations until it was broken up by the U.S government in 1911 due to antitrust laws.The Wealth of Nations

: "The Wealth of Nations" is a book written by Adam Smith in 1776, which outlines the principles of free market economics and capitalism. It argues that self-interest and competition are driving forces behind economic prosperity.Trusts

: In terms of U.S history, trusts refer to large business entities that are formed with intent to monopolize and control market share by eliminating competition through consolidation of companies.United States Steel Corporation

: The United States Steel Corporation, often referred to as U.S. Steel, is a major steel producing company established in 1901 by J.P. Morgan and Elbert H. Gary. It was the world's first billion-dollar corporation and was once the largest steel producer and largest corporation in the world.US Steel Corporation

: The U.S. Steel Corporation is an integrated steel producer with major production operations in the United States, Canada, and Central Europe, founded by J.P. Morgan and Elbert H. Gary in 1901.Vertical Integration

: Vertical integration is when a company controls more than one stage of the supply chain for a product, from the raw materials to manufacturing and distribution.Washington Monument

: The Washington Monument is an obelisk on the National Mall in Washington, D.C., built to commemorate George Washington, the first President of the United States.William Kelly

: William Kelly was an American inventor and businessman who played a significant role in the development of the Bessemer process for steel production.

Resources

© 2024 Fiveable Inc. All rights reserved.

AP® and SAT® are trademarks registered by the College Board, which is not affiliated with, and does not endorse this website.