3.6 Firms' Short-Run Decisions to Produce and Long-Run Decisions to Enter or Exit a Market

5 min read•december 22, 2022

dylan_black_2025

Jeanne Stansak

dylan_black_2025

Jeanne Stansak

Entering and Exiting a Market

A perfectly-competitive market is a market marked by a few key points. This section will focus on the fact that a perfectly-competitive market has many sellers and low barriers to entry. This means that, in theory, anyone can open their own business in a perfectly-competitive market, and anyone can leave the market at will. This section will help us understand how and why a firm may enter or exit a market, but first, let's get some definitions in place.

A firm enters a market when it opens business and begins selling product. That is, when their quantity isn't 0. A firm exiting the market is not the same as completely going out of business. Instead, a firm exiting a market means the firm has decided not to produce any quantity. The actual firm may still "exist," but for our purposes exiting a market means you don't produce anything.

The Shut-Down Rule

In the short-run, firms will decide to operate or shut down by comparing total revenue to total variable cost, or price to average variable cost (AVC). This is because in the short run, there will always be a fixed cost regardless of quantity, even if quantity is zero. They will shut down when the price of the good or service drops below the average variable cost. We call this the shutdown rule, which states that the firm should continue to operate as long as the price is equal to or above the AVC.

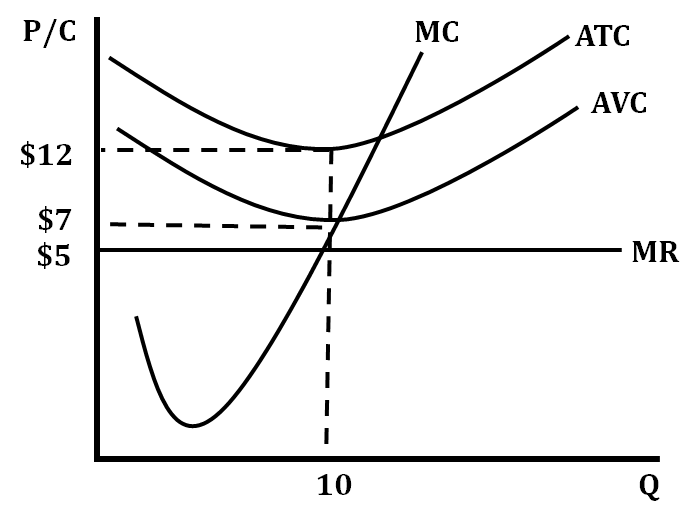

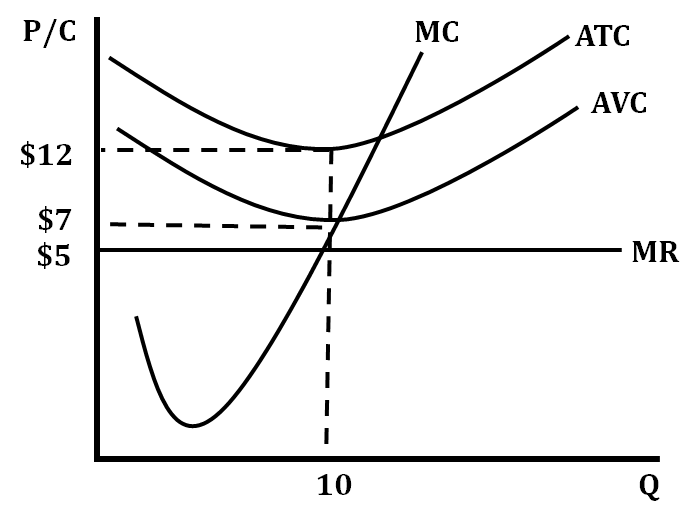

In the graph above, you can see that at the profit maximizing (MR = MC) quantity of 10, the price is below the AVC of $7. Based on the shutdown rule, this particular firm would choose not to operate and, instead, pay their fixed costs because that would be less than its overall costs if it were to continue to operate.

This can be summed up in the following:

If you cannot cover your costs for producing goods, then you shouldn't produce any goods at all. Instead, take the hit on your fixed costs only.

Let's look at this using specific numbers. The total revenue this firm makes when it produces at the profit maximizing point is $50 ($5 x 10). The total costs are $120 ($12 x 10). If it chooses to operate they would incur an economic loss of $70 ($50 - $120 = -$70). However, if they choose to shut down, they would only be responsible for their fixed costs, which in this case would be $5 x 10 for a total of $50.

Remember the vertical difference between the ATC and AVC represents the AFC and that is how we determine that the AFC is $5 ($12-$7). We then multiply it by the number of products they are producing. We get a total fixed cost of $50, which is less than their economic loss if they chose to continue to operate.

Fun fact! This is out of scope for AP Micro, but producer surplus for a firm is actually exactly equal to their variable profit. That is, PS = TR - VC (not TC). When price is less than variable cost in a perfectly competitive market, the firm will have negative producer surplus - that is, they lose surplus! This is part of why the shut-down rule exists.

Long-Run Decisions to Enter or Exit the Market

When a firm is earning either a profit or a loss in the short run, it serves as a guide for other firms to either enter or exit the market. If the firm is earning a loss while still continuing to operate, then we will see firms exit that particular industry in the long-run. Remember, in the long-run, all inputs are variable, meaning a firm can completely avoid their costs by exiting the market (since no costs are fixed in the long-run!). Thus, if firms are making a loss at all, they completely leave the market in the long-run, until either positive or normal profits are made, at which point they can re-enter the market.

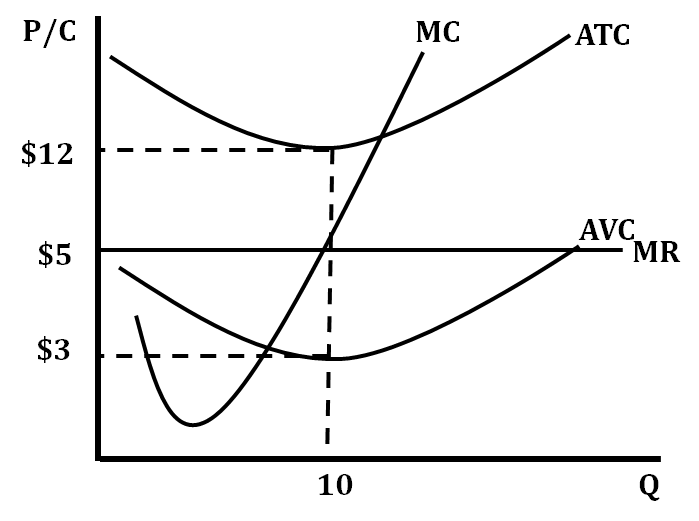

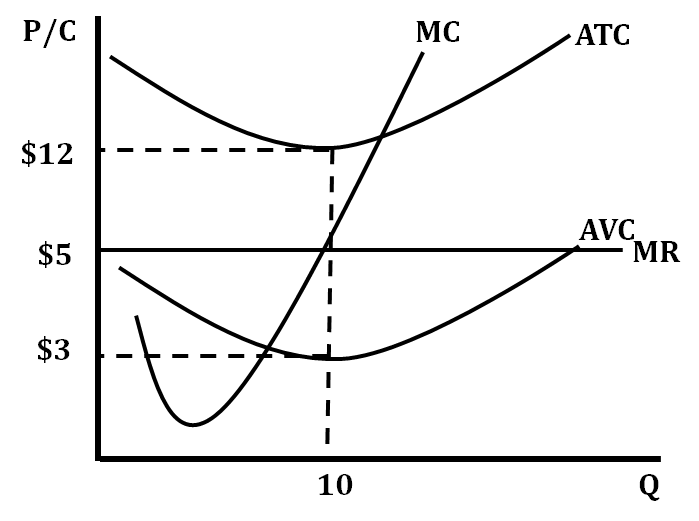

In the graph below, we have a particular firm that is earning a loss in the short-run but is still operating. As a result of this situation, in the long-run, we will see individual firms start to leave the industry because of the lack of profit that is available.

The graph shows that the total revenue earned would be $50 (10 x $5) but the total costs are $120 (10 x ATC of $12), so they are earning an economic loss of $70. Their fixed costs are $90 (vertical difference between ATC and AVC, $9, multiplied by the quantity, 10). Since their fixed costs are greater than their economic losses, and AVC < Price, they will continue to operate rather than shut down. However, we will see firms start to leave this industry as there is no potential for profits.

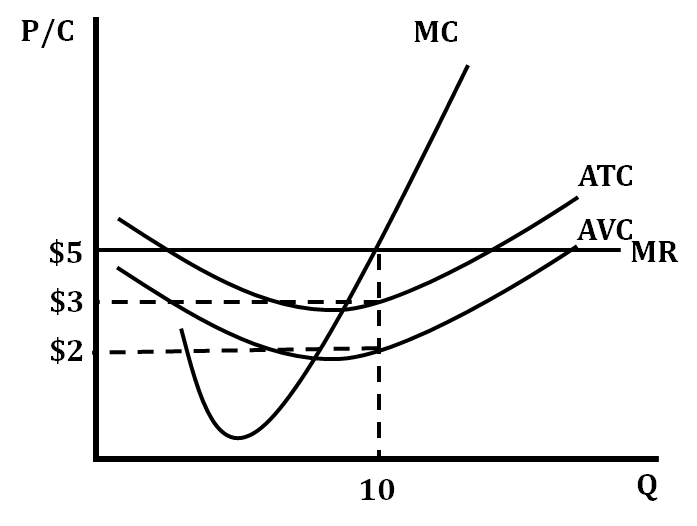

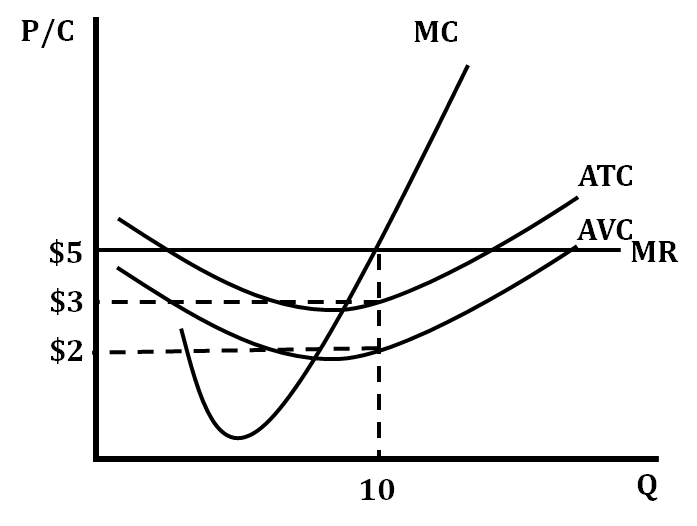

In the situation where the firm is earning a profit in the short run, we will see the attraction of new firms to the industry since there is potential to earn a profit. In the graph below, we see that the total revenue earned by this firm is $50 and their total costs are only $30. This means that they are earning an economic profit of $20, making other firms interested in entering this industry.

What Happens To The Market When Firms Enter or Exit?

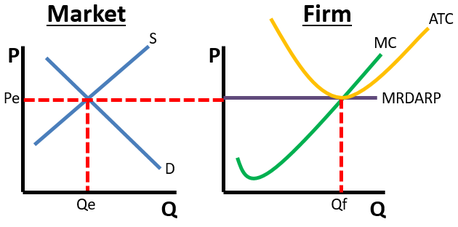

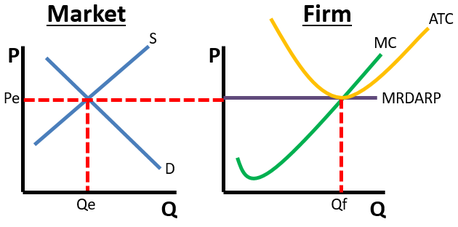

Because all perfectly-competitive firms are price takers, the market is impacted when firms enter and/or exit. This can be seen by looking at the side by side graph for a perfectly competitive market:

Price is determined by the equilibrum price in the market, so any shifts in S or D will lead to a reduction or increase in MR = D= AR = P.

When a firm enters the market, supply will shift right. This will decrease our price, driving MR = D = AR = P down.

Conversely, when a firm leaves the market, supply will shift left. This will increase our price, driving MR = D = AR = P up.

Because firms only enter when profitable and leave when losing, in the long run, profits will equilibrate to be normal. This is because if profits are present, the price will eventually be driven down, decreasing revenue and eventually profits will fall to zero. If losses are present, the price will eventually be driven up, increasing revenue and eventually profits will rise to zero. This will be elaborated on in 3.7.

Key Terms to Review (18)

Average Fixed Cost (AFC)

: Average Fixed Cost is calculated by dividing fixed costs by the quantity produced. It represents the fixed cost per unit of output for a firm.Average Total Cost (ATC)

: ATC refers to the average cost of producing each unit of output. It is calculated by dividing total cost by the quantity produced.Average Variable Cost (AVC)

: Average variable cost (AVC) is obtained by dividing total variable cost by the quantity produced. It shows how much each unit of output contributes to covering variable costs.Economic Loss

: Economic loss occurs when a firm's total revenue is less than its total cost, including both explicit and implicit costs. In other words, it means the business is not generating enough income to cover all of its expenses.Equilibrium Price

: The equilibrium price is the price at which the quantity demanded of a good or service equals the quantity supplied, resulting in market stability.Firm Exiting a Market

: When a firm decides to permanently leave a specific market due to various reasons such as low profitability or intense competition.Fixed Cost

: Fixed costs are expenses that do not change regardless of changes in production levels or sales volume. They include items like rent, insurance, and salaries.Inputs are variable

: Inputs are variable refers to the resources or factors of production that can be adjusted or changed in quantity based on the needs of a firm. These inputs include labor, capital, and raw materials.Long-Run Decisions

: Long-run decisions refer to choices made by firms that involve adjusting their inputs and production levels over a longer period of time. These decisions are based on the analysis of both fixed and variable costs.Normal Profits

: Normal profits, also known as zero economic profits, refer to the level of profit that allows a firm to cover all its costs and earn a return equal to what it could earn in an alternative investment. In other words, normal profits are the minimum level of profit necessary for a business to stay in operation.Perfectly-Competitive Market

: A perfectly-competitive market is a market structure where there are many buyers and sellers, all selling identical products, and no single buyer or seller has the power to influence the price.Price Takers

: Price takers are firms that have no control over the price of their product in the market. They must accept the prevailing market price and adjust their quantity supplied accordingly.Producer Surplus

: Producer surplus refers to the difference between what producers are willing to sell a good for and what they actually receive. It represents their economic gain from selling a product at a price higher than their minimum acceptable price.Profit Maximizing

: Profit maximizing refers to the process of determining the level of output that will generate the highest possible profit for a firm. It involves comparing marginal revenue and marginal cost.Shut-Down Rule

: The shut-down rule states that in the short run, a firm should shut down production if the price falls below average variable cost (AVC).Total Revenue

: Total revenue refers to the overall income generated by a firm from selling its goods or services. It is calculated by multiplying the quantity sold by the price per unit.Total Variable Cost

: Total variable cost refers to the sum of all costs that vary with the level of production, such as labor and raw materials. It does not include fixed costs.Variable Profit

: Variable profit refers to the amount of money earned by a firm after deducting all variable costs from its total revenue. It represents the portion of profit that can change based on changes in production levels.3.6 Firms' Short-Run Decisions to Produce and Long-Run Decisions to Enter or Exit a Market

5 min read•december 22, 2022

dylan_black_2025

Jeanne Stansak

dylan_black_2025

Jeanne Stansak

Entering and Exiting a Market

A perfectly-competitive market is a market marked by a few key points. This section will focus on the fact that a perfectly-competitive market has many sellers and low barriers to entry. This means that, in theory, anyone can open their own business in a perfectly-competitive market, and anyone can leave the market at will. This section will help us understand how and why a firm may enter or exit a market, but first, let's get some definitions in place.

A firm enters a market when it opens business and begins selling product. That is, when their quantity isn't 0. A firm exiting the market is not the same as completely going out of business. Instead, a firm exiting a market means the firm has decided not to produce any quantity. The actual firm may still "exist," but for our purposes exiting a market means you don't produce anything.

The Shut-Down Rule

In the short-run, firms will decide to operate or shut down by comparing total revenue to total variable cost, or price to average variable cost (AVC). This is because in the short run, there will always be a fixed cost regardless of quantity, even if quantity is zero. They will shut down when the price of the good or service drops below the average variable cost. We call this the shutdown rule, which states that the firm should continue to operate as long as the price is equal to or above the AVC.

In the graph above, you can see that at the profit maximizing (MR = MC) quantity of 10, the price is below the AVC of $7. Based on the shutdown rule, this particular firm would choose not to operate and, instead, pay their fixed costs because that would be less than its overall costs if it were to continue to operate.

This can be summed up in the following:

If you cannot cover your costs for producing goods, then you shouldn't produce any goods at all. Instead, take the hit on your fixed costs only.

Let's look at this using specific numbers. The total revenue this firm makes when it produces at the profit maximizing point is $50 ($5 x 10). The total costs are $120 ($12 x 10). If it chooses to operate they would incur an economic loss of $70 ($50 - $120 = -$70). However, if they choose to shut down, they would only be responsible for their fixed costs, which in this case would be $5 x 10 for a total of $50.

Remember the vertical difference between the ATC and AVC represents the AFC and that is how we determine that the AFC is $5 ($12-$7). We then multiply it by the number of products they are producing. We get a total fixed cost of $50, which is less than their economic loss if they chose to continue to operate.

Fun fact! This is out of scope for AP Micro, but producer surplus for a firm is actually exactly equal to their variable profit. That is, PS = TR - VC (not TC). When price is less than variable cost in a perfectly competitive market, the firm will have negative producer surplus - that is, they lose surplus! This is part of why the shut-down rule exists.

Long-Run Decisions to Enter or Exit the Market

When a firm is earning either a profit or a loss in the short run, it serves as a guide for other firms to either enter or exit the market. If the firm is earning a loss while still continuing to operate, then we will see firms exit that particular industry in the long-run. Remember, in the long-run, all inputs are variable, meaning a firm can completely avoid their costs by exiting the market (since no costs are fixed in the long-run!). Thus, if firms are making a loss at all, they completely leave the market in the long-run, until either positive or normal profits are made, at which point they can re-enter the market.

In the graph below, we have a particular firm that is earning a loss in the short-run but is still operating. As a result of this situation, in the long-run, we will see individual firms start to leave the industry because of the lack of profit that is available.

The graph shows that the total revenue earned would be $50 (10 x $5) but the total costs are $120 (10 x ATC of $12), so they are earning an economic loss of $70. Their fixed costs are $90 (vertical difference between ATC and AVC, $9, multiplied by the quantity, 10). Since their fixed costs are greater than their economic losses, and AVC < Price, they will continue to operate rather than shut down. However, we will see firms start to leave this industry as there is no potential for profits.

In the situation where the firm is earning a profit in the short run, we will see the attraction of new firms to the industry since there is potential to earn a profit. In the graph below, we see that the total revenue earned by this firm is $50 and their total costs are only $30. This means that they are earning an economic profit of $20, making other firms interested in entering this industry.

What Happens To The Market When Firms Enter or Exit?

Because all perfectly-competitive firms are price takers, the market is impacted when firms enter and/or exit. This can be seen by looking at the side by side graph for a perfectly competitive market:

Price is determined by the equilibrum price in the market, so any shifts in S or D will lead to a reduction or increase in MR = D= AR = P.

When a firm enters the market, supply will shift right. This will decrease our price, driving MR = D = AR = P down.

Conversely, when a firm leaves the market, supply will shift left. This will increase our price, driving MR = D = AR = P up.

Because firms only enter when profitable and leave when losing, in the long run, profits will equilibrate to be normal. This is because if profits are present, the price will eventually be driven down, decreasing revenue and eventually profits will fall to zero. If losses are present, the price will eventually be driven up, increasing revenue and eventually profits will rise to zero. This will be elaborated on in 3.7.

Key Terms to Review (18)

Average Fixed Cost (AFC)

: Average Fixed Cost is calculated by dividing fixed costs by the quantity produced. It represents the fixed cost per unit of output for a firm.Average Total Cost (ATC)

: ATC refers to the average cost of producing each unit of output. It is calculated by dividing total cost by the quantity produced.Average Variable Cost (AVC)

: Average variable cost (AVC) is obtained by dividing total variable cost by the quantity produced. It shows how much each unit of output contributes to covering variable costs.Economic Loss

: Economic loss occurs when a firm's total revenue is less than its total cost, including both explicit and implicit costs. In other words, it means the business is not generating enough income to cover all of its expenses.Equilibrium Price

: The equilibrium price is the price at which the quantity demanded of a good or service equals the quantity supplied, resulting in market stability.Firm Exiting a Market

: When a firm decides to permanently leave a specific market due to various reasons such as low profitability or intense competition.Fixed Cost

: Fixed costs are expenses that do not change regardless of changes in production levels or sales volume. They include items like rent, insurance, and salaries.Inputs are variable

: Inputs are variable refers to the resources or factors of production that can be adjusted or changed in quantity based on the needs of a firm. These inputs include labor, capital, and raw materials.Long-Run Decisions

: Long-run decisions refer to choices made by firms that involve adjusting their inputs and production levels over a longer period of time. These decisions are based on the analysis of both fixed and variable costs.Normal Profits

: Normal profits, also known as zero economic profits, refer to the level of profit that allows a firm to cover all its costs and earn a return equal to what it could earn in an alternative investment. In other words, normal profits are the minimum level of profit necessary for a business to stay in operation.Perfectly-Competitive Market

: A perfectly-competitive market is a market structure where there are many buyers and sellers, all selling identical products, and no single buyer or seller has the power to influence the price.Price Takers

: Price takers are firms that have no control over the price of their product in the market. They must accept the prevailing market price and adjust their quantity supplied accordingly.Producer Surplus

: Producer surplus refers to the difference between what producers are willing to sell a good for and what they actually receive. It represents their economic gain from selling a product at a price higher than their minimum acceptable price.Profit Maximizing

: Profit maximizing refers to the process of determining the level of output that will generate the highest possible profit for a firm. It involves comparing marginal revenue and marginal cost.Shut-Down Rule

: The shut-down rule states that in the short run, a firm should shut down production if the price falls below average variable cost (AVC).Total Revenue

: Total revenue refers to the overall income generated by a firm from selling its goods or services. It is calculated by multiplying the quantity sold by the price per unit.Total Variable Cost

: Total variable cost refers to the sum of all costs that vary with the level of production, such as labor and raw materials. It does not include fixed costs.Variable Profit

: Variable profit refers to the amount of money earned by a firm after deducting all variable costs from its total revenue. It represents the portion of profit that can change based on changes in production levels.

Resources

© 2024 Fiveable Inc. All rights reserved.

AP® and SAT® are trademarks registered by the College Board, which is not affiliated with, and does not endorse this website.