Unit 4 Overview: Financial Sector

5 min read•january 8, 2023

Haseung Jun

Haseung Jun

Intro to Unit 4

The Financial Sector

We can't let the government have all the fun when the economy falls out of equilibrium! In this unit, we will explore how changes in the can affect our economy. These changes can come naturally but often result from the carried out by the (the FED).

4.1 Financial Assets

Before we can dive into the FED and their economy stabilizing techniques, it will help review the basics of the financial sector. The basic building block of the financial sector is money 💰, and while we all interact with it daily, we might not know that we can hold other assets in place of money - like , , and other .

Each asset has different characteristics, and we often refer to them based on their , , and the amount of we take when holding that asset. In general, the more the - the greater the reward (or the more catastrophic the loss). While economics is vastly different from finance, this unit introduces some assets that cross into both disciplines, like and .

4.2 Nominal vs. Real Interest Rates

We hear about interest rates all the time: on TV, the radio, in the newspaper. The topic is almost inescapable. In Unit 4, we'll investigate how interest rates can affect other things, and we'll learn to identify both the (not adjusted for inflation) and the (adjusted for inflation). Finally, we will learn how to calculate these different rates and understand the relationship between them and the expected .

4.3 Definition, Measurement, and Functions of Money

🎵Money, money, money….Mon-ey!🎶 (If you don't know that song - look it up!) We use it every day, but what do we really know about money 💵? There are three functions of money: medium of exchange, , and ; each will pop up in this unit. Additionally, we learn how the money supply is measured and included in each category (, , and ).

4.4 Banking and the Expansion of the Money Market

Now that we've covered money, it is crucial to explore where we keep our money. No, I'm not talking about under the mattress! I am talking about the banking system 💲. Here in the United States, we use a fractional banking system, which essentially means that banks are only required to keep a fraction (hence the name) of their holdings in the vault. They are free to loan out most of the money that we deposit into the bank as .

The money they are required to hold is called the . Before we freak out too much about the fact that our bank is lending out our deposits, know that there are , which the banks keep on hand, above and beyond what is required.

This, of course, allows for another multiplier! The allows us to calculate the amount of money that banks can generate from their . It is an explanation of how banks can create money from thin air!

By dividing one by the (set by the FED), one can calculate the . For example, a of 20% would create a of 5 (1/.2). That means that a bank can create five times the amount of money as their . A $100 deposit would create $80 in ($20 would be ) and up to $400 ($80 x 5) in brand new money!

Keeping track of all of these and reserves can be a confusing task. Enter the Bank Balance Sheet (aka T-accounts) to save the day and keep things in order. This simple accounting tool allows one to separate the assets from the liabilities and keep them balanced (just like the name).

4.5 The Money Market

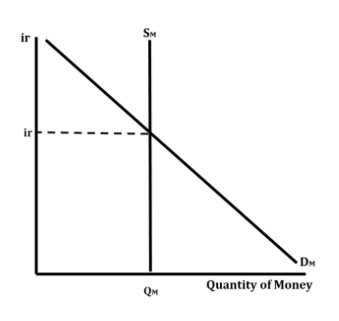

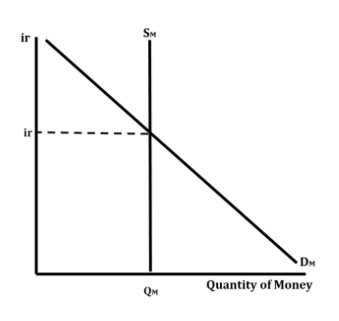

Now that we've explored money, we must dive into the . The demand curve for money looks much like every other demand curve that we have explored, but with nominal interest on the y axis. The quantity demanded of Money is only affected by the (or the price of money). However, three things can shift the demand: , , and .

In this section of the unit, you will learn how and why these shifters affect the demand for money.

The FED determines the supply of money, which is independent of the . That means the supply curve for money is a vertical line. The place where the two curves come together is the .

4.6 Monetary Policy

In the last unit, we looked at how the government interacts in the economy through . In this unit, we will explore the central bank's actions - or the Federal Reserve - known as .

Like , these actions have two main goals: expansion and contraction. There are three main tools: setting the (the interest rate that the FED charges banks), setting the (the percentage of all that banks must hold), and (the buying and selling of ). Each of these tools can influence the money supply and, therefore, the economy as a whole.

4.7 The Loanable Funds Market

The last topic of this unit dives into the , which illustrates the interaction between savers and borrowers in our economy. Like other markets we have looked at, a series of determinants affect the supply, demand, and equilibrium of the . Similarly to basic supply and demand, the uses the on the y axis, and becomes the price of loanable funds.

Key Terms to Review (36)

Bank Balance Sheet (T-Accounts)

: A bank balance sheet, also known as T-Accounts, is a financial statement that shows the assets and liabilities of a bank at a specific point in time. It provides a snapshot of the bank's financial position.Bonds

: Bonds are debt securities issued by governments, municipalities, corporations, or other entities to raise capital. When you purchase bonds, you are essentially lending money with the expectation that it will be repaid with interest over time.Demand Deposits

: Demand deposits refer to funds held in a bank account that can be withdrawn at any time without prior notice. These accounts are typically used for everyday transactions and do not earn interest.Discount Rate

: The discount rate is the interest rate at which commercial banks can borrow funds directly from the Federal Reserve.Excess Reserves

: Excess reserves are funds held by banks that exceed their required reserve ratio, which is the minimum amount they must keep on hand based on customer deposits.Federal Reserve Bank

: The Federal Reserve Bank, often referred to as the Fed, is the central banking system of the United States. It is responsible for conducting monetary policy, supervising and regulating banks, and maintaining financial stability in the country.Financial Assets

: Financial assets refer to any form of ownership or claim on an entity that has monetary value. These assets can include stocks, bonds, cash, and other investments.Fiscal Policy

: Fiscal policy refers to the government's use of taxation and spending to influence the economy. It involves decisions on how much money the government should collect in taxes and how much it should spend on public goods and services.Inflation Rate

: The inflation rate refers to the percentage increase in the general price level of goods and services over a specific period of time. It measures how fast prices are rising and indicates the rate at which the purchasing power of money is decreasing.Investments

: Investments refer to the purchase of goods, services, or assets with the expectation of generating income or profit in the future. In macroeconomics, investments include spending on capital goods such as machinery, equipment, and infrastructure.Liquidity

: Liquidity refers to how easily an asset can be converted into cash without significant loss in its value.Loanable Funds Market

: The loanable funds market represents the interaction between borrowers and lenders in an economy. It determines the equilibrium interest rate and quantity of loanable funds available for investment or borrowing.M1

: M1 refers to the narrowest definition of money supply, which includes physical currency (coins and paper money) in circulation, demand deposits (checking accounts), and traveler's checks.M2

: M2 represents a broader measure of money supply than M1. It includes all components of M1 plus savings deposits, time deposits (certificates of deposit), and retail money market funds.M3

: M3 represents the broadest measure of money supply. It includes all components of both M1 and M2 plus large time deposits held by institutional investors.Monetary Policy

: Monetary policy refers to actions taken by a central bank (such as adjusting interest rates or controlling money supply) to manage and stabilize an economy's money supply, credit availability, and interest rates.Money Market

: The money market refers to the global marketplace where short-term borrowing and lending of funds take place. It includes various financial instruments such as Treasury bills, commercial paper, and certificates of deposit.Money market equilibrium

: Money market equilibrium refers to the state in which the demand for money equals the supply of money, resulting in a stable interest rate. It occurs when individuals and businesses are willing to hold exactly the amount of money available in the economy.Money Multiplier

: The money multiplier is the factor by which an initial deposit in a bank can increase the total money supply through the process of fractional reserve banking.Money Supply Measurement

: Money supply measurement refers to methods used by economists and policymakers to track and quantify the amount of money circulating within an economy at any given time.Nominal Interest Rate

: The nominal interest rate refers to the percentage increase in money value that a lender receives from a borrower as compensation for lending money.Open-Market Operations

: Open-market operations refer to when the central bank buys or sells government securities (such as Treasury bonds) in order to influence interest rates and control the money supply.Price level

: The price level represents the average level of prices for goods and services in an economy at a given point in time.Rate of Return

: Rate of return is the gain or loss on an investment relative to the amount invested, expressed as a percentage. It measures the profitability of an investment over a specific period.Real GDP

: Real GDP refers to the total value of all goods and services produced within a country's borders, adjusted for inflation. It measures the economic output of a nation over a specific period.Real Interest Rate

: The real interest rate is the nominal interest rate adjusted for inflation. It represents the purchasing power of borrowed or invested money after accounting for changes in prices over time.Required Reserves

: Required reserves are the minimum amount of funds that banks must hold in reserve against their customers' deposits. These reserves are set by central banks to ensure stability in the banking system and control inflation.Reserve Ratio/Requirement

: The reserve ratio, also known as the reserve requirement, refers to the percentage of deposits that banks are required to hold in reserves. It is set by the central bank and helps regulate the amount of money banks can lend out.Reserve Requirement

: The reserve requirement is the percentage of deposits that banks are required to hold as reserves, which cannot be loaned out. It is set by the central bank to control the amount of money in circulation.Risk

: Risk refers to the potential for loss or uncertainty in an investment or decision. It is the chance that an outcome may differ from what was expected.Stocks

: Stocks represent ownership shares in a company. When you buy stocks, you become a partial owner and have the potential to earn profits through dividends and capital appreciation.Store of Value

: A store of value is an attribute of money that enables it to hold its purchasing power over time.Supply and Demand Determinants

: Supply and demand determinants are factors that influence changes in supply or demand for a particular good or service. These determinants can shift the entire supply curve or demand curve.Transaction Costs

: Transaction costs refer to the expenses incurred when buying or selling goods, services, or assets. These costs include fees, commissions, and other charges associated with completing a transaction.Treasury bonds

: Treasury bonds are long-term debt securities issued by the U.S. Department of Treasury with a maturity period of 10 years or more. They are considered low-risk investments because they are backed by the full faith and credit of the U.S. government.Unit of Account

: A unit of account is a function of money that allows it to be used as a common measure for expressing the value of goods, services, and assets.Unit 4 Overview: Financial Sector

5 min read•january 8, 2023

Haseung Jun

Haseung Jun

Intro to Unit 4

The Financial Sector

We can't let the government have all the fun when the economy falls out of equilibrium! In this unit, we will explore how changes in the can affect our economy. These changes can come naturally but often result from the carried out by the (the FED).

4.1 Financial Assets

Before we can dive into the FED and their economy stabilizing techniques, it will help review the basics of the financial sector. The basic building block of the financial sector is money 💰, and while we all interact with it daily, we might not know that we can hold other assets in place of money - like , , and other .

Each asset has different characteristics, and we often refer to them based on their , , and the amount of we take when holding that asset. In general, the more the - the greater the reward (or the more catastrophic the loss). While economics is vastly different from finance, this unit introduces some assets that cross into both disciplines, like and .

4.2 Nominal vs. Real Interest Rates

We hear about interest rates all the time: on TV, the radio, in the newspaper. The topic is almost inescapable. In Unit 4, we'll investigate how interest rates can affect other things, and we'll learn to identify both the (not adjusted for inflation) and the (adjusted for inflation). Finally, we will learn how to calculate these different rates and understand the relationship between them and the expected .

4.3 Definition, Measurement, and Functions of Money

🎵Money, money, money….Mon-ey!🎶 (If you don't know that song - look it up!) We use it every day, but what do we really know about money 💵? There are three functions of money: medium of exchange, , and ; each will pop up in this unit. Additionally, we learn how the money supply is measured and included in each category (, , and ).

4.4 Banking and the Expansion of the Money Market

Now that we've covered money, it is crucial to explore where we keep our money. No, I'm not talking about under the mattress! I am talking about the banking system 💲. Here in the United States, we use a fractional banking system, which essentially means that banks are only required to keep a fraction (hence the name) of their holdings in the vault. They are free to loan out most of the money that we deposit into the bank as .

The money they are required to hold is called the . Before we freak out too much about the fact that our bank is lending out our deposits, know that there are , which the banks keep on hand, above and beyond what is required.

This, of course, allows for another multiplier! The allows us to calculate the amount of money that banks can generate from their . It is an explanation of how banks can create money from thin air!

By dividing one by the (set by the FED), one can calculate the . For example, a of 20% would create a of 5 (1/.2). That means that a bank can create five times the amount of money as their . A $100 deposit would create $80 in ($20 would be ) and up to $400 ($80 x 5) in brand new money!

Keeping track of all of these and reserves can be a confusing task. Enter the Bank Balance Sheet (aka T-accounts) to save the day and keep things in order. This simple accounting tool allows one to separate the assets from the liabilities and keep them balanced (just like the name).

4.5 The Money Market

Now that we've explored money, we must dive into the . The demand curve for money looks much like every other demand curve that we have explored, but with nominal interest on the y axis. The quantity demanded of Money is only affected by the (or the price of money). However, three things can shift the demand: , , and .

In this section of the unit, you will learn how and why these shifters affect the demand for money.

The FED determines the supply of money, which is independent of the . That means the supply curve for money is a vertical line. The place where the two curves come together is the .

4.6 Monetary Policy

In the last unit, we looked at how the government interacts in the economy through . In this unit, we will explore the central bank's actions - or the Federal Reserve - known as .

Like , these actions have two main goals: expansion and contraction. There are three main tools: setting the (the interest rate that the FED charges banks), setting the (the percentage of all that banks must hold), and (the buying and selling of ). Each of these tools can influence the money supply and, therefore, the economy as a whole.

4.7 The Loanable Funds Market

The last topic of this unit dives into the , which illustrates the interaction between savers and borrowers in our economy. Like other markets we have looked at, a series of determinants affect the supply, demand, and equilibrium of the . Similarly to basic supply and demand, the uses the on the y axis, and becomes the price of loanable funds.

Key Terms to Review (36)

Bank Balance Sheet (T-Accounts)

: A bank balance sheet, also known as T-Accounts, is a financial statement that shows the assets and liabilities of a bank at a specific point in time. It provides a snapshot of the bank's financial position.Bonds

: Bonds are debt securities issued by governments, municipalities, corporations, or other entities to raise capital. When you purchase bonds, you are essentially lending money with the expectation that it will be repaid with interest over time.Demand Deposits

: Demand deposits refer to funds held in a bank account that can be withdrawn at any time without prior notice. These accounts are typically used for everyday transactions and do not earn interest.Discount Rate

: The discount rate is the interest rate at which commercial banks can borrow funds directly from the Federal Reserve.Excess Reserves

: Excess reserves are funds held by banks that exceed their required reserve ratio, which is the minimum amount they must keep on hand based on customer deposits.Federal Reserve Bank

: The Federal Reserve Bank, often referred to as the Fed, is the central banking system of the United States. It is responsible for conducting monetary policy, supervising and regulating banks, and maintaining financial stability in the country.Financial Assets

: Financial assets refer to any form of ownership or claim on an entity that has monetary value. These assets can include stocks, bonds, cash, and other investments.Fiscal Policy

: Fiscal policy refers to the government's use of taxation and spending to influence the economy. It involves decisions on how much money the government should collect in taxes and how much it should spend on public goods and services.Inflation Rate

: The inflation rate refers to the percentage increase in the general price level of goods and services over a specific period of time. It measures how fast prices are rising and indicates the rate at which the purchasing power of money is decreasing.Investments

: Investments refer to the purchase of goods, services, or assets with the expectation of generating income or profit in the future. In macroeconomics, investments include spending on capital goods such as machinery, equipment, and infrastructure.Liquidity

: Liquidity refers to how easily an asset can be converted into cash without significant loss in its value.Loanable Funds Market

: The loanable funds market represents the interaction between borrowers and lenders in an economy. It determines the equilibrium interest rate and quantity of loanable funds available for investment or borrowing.M1

: M1 refers to the narrowest definition of money supply, which includes physical currency (coins and paper money) in circulation, demand deposits (checking accounts), and traveler's checks.M2

: M2 represents a broader measure of money supply than M1. It includes all components of M1 plus savings deposits, time deposits (certificates of deposit), and retail money market funds.M3

: M3 represents the broadest measure of money supply. It includes all components of both M1 and M2 plus large time deposits held by institutional investors.Monetary Policy

: Monetary policy refers to actions taken by a central bank (such as adjusting interest rates or controlling money supply) to manage and stabilize an economy's money supply, credit availability, and interest rates.Money Market

: The money market refers to the global marketplace where short-term borrowing and lending of funds take place. It includes various financial instruments such as Treasury bills, commercial paper, and certificates of deposit.Money market equilibrium

: Money market equilibrium refers to the state in which the demand for money equals the supply of money, resulting in a stable interest rate. It occurs when individuals and businesses are willing to hold exactly the amount of money available in the economy.Money Multiplier

: The money multiplier is the factor by which an initial deposit in a bank can increase the total money supply through the process of fractional reserve banking.Money Supply Measurement

: Money supply measurement refers to methods used by economists and policymakers to track and quantify the amount of money circulating within an economy at any given time.Nominal Interest Rate

: The nominal interest rate refers to the percentage increase in money value that a lender receives from a borrower as compensation for lending money.Open-Market Operations

: Open-market operations refer to when the central bank buys or sells government securities (such as Treasury bonds) in order to influence interest rates and control the money supply.Price level

: The price level represents the average level of prices for goods and services in an economy at a given point in time.Rate of Return

: Rate of return is the gain or loss on an investment relative to the amount invested, expressed as a percentage. It measures the profitability of an investment over a specific period.Real GDP

: Real GDP refers to the total value of all goods and services produced within a country's borders, adjusted for inflation. It measures the economic output of a nation over a specific period.Real Interest Rate

: The real interest rate is the nominal interest rate adjusted for inflation. It represents the purchasing power of borrowed or invested money after accounting for changes in prices over time.Required Reserves

: Required reserves are the minimum amount of funds that banks must hold in reserve against their customers' deposits. These reserves are set by central banks to ensure stability in the banking system and control inflation.Reserve Ratio/Requirement

: The reserve ratio, also known as the reserve requirement, refers to the percentage of deposits that banks are required to hold in reserves. It is set by the central bank and helps regulate the amount of money banks can lend out.Reserve Requirement

: The reserve requirement is the percentage of deposits that banks are required to hold as reserves, which cannot be loaned out. It is set by the central bank to control the amount of money in circulation.Risk

: Risk refers to the potential for loss or uncertainty in an investment or decision. It is the chance that an outcome may differ from what was expected.Stocks

: Stocks represent ownership shares in a company. When you buy stocks, you become a partial owner and have the potential to earn profits through dividends and capital appreciation.Store of Value

: A store of value is an attribute of money that enables it to hold its purchasing power over time.Supply and Demand Determinants

: Supply and demand determinants are factors that influence changes in supply or demand for a particular good or service. These determinants can shift the entire supply curve or demand curve.Transaction Costs

: Transaction costs refer to the expenses incurred when buying or selling goods, services, or assets. These costs include fees, commissions, and other charges associated with completing a transaction.Treasury bonds

: Treasury bonds are long-term debt securities issued by the U.S. Department of Treasury with a maturity period of 10 years or more. They are considered low-risk investments because they are backed by the full faith and credit of the U.S. government.Unit of Account

: A unit of account is a function of money that allows it to be used as a common measure for expressing the value of goods, services, and assets.

Resources

© 2024 Fiveable Inc. All rights reserved.

AP® and SAT® are trademarks registered by the College Board, which is not affiliated with, and does not endorse this website.